What’s New?

Scroll for helpful tips, stories, and news.

February 2nd - Weekly Market Report

Financial markets churned on Friday as investors tried to figure out what the President’s new nominee to lead the Federal Reserve, will mean for interest rates.

January 26th - Weekly Market Report

The market drifted through narrow trading Friday, as a zigzag week punctuated by threats and reversal of directions ended with a quiet and tentative close.

January 20th - Weekly Market Report

Stocks ended slightly lower on Friday as the first week of corporate earnings season ended with markets trading near record levels.

January 12th - Weekly Market Report

I believe that the stronger gains after a mixed to lower start was the result by the Supreme Court not issuing a decision after the President’s tariff situation on Friday which could have been negative for equities had it gone against his wishes.

January 5th - Weekly Market Report

After doing well in the first of the two final weeks of the year, as has been the historical pattern, the major indices all declined in the week just ended and thus broke what had been a pretty consistent pattern of gaining nicely in the final two weeks of the calendar year.

Economic Pulse Heading into the Holidays

As we approach the holiday season, the economic landscape reflects a mix of cautious optimism and resilience.

Happy Thanksgiving!

As we gather around the table this Thanksgiving, it’s easy to focus on what we’re thankful for—family, friends, and the moments that make life rich. But gratitude isn’t just an emotion; it’s a powerful mindset that can transform the way we approach money.

Economic Weather Report

As we step into the final stretch of 2025, the economic landscape feels like a mix of clearing skies and lingering clouds. Here’s what’s shaping the horizon:

Inflation is cooling, but not quite cold. Prices are rising at about 3% year-over-year—a big improvement from the peaks of 2022–2023.

Economic Outlook: Precarious Crossroads

As October draws to a close, the American economy finds itself at a precarious crossroads. The federal government shutdown, now entering its 30th day, has become more than a political standoff—it’s a slow bleed on economic momentum.

U.S. Economic Outlook: Navigating Uncertainty

As we head into the final stretch of October, the U.S. economy is balancing on a tightrope—caught between inflationary pressures, a cooling labor market, and a government shutdown that’s clouding visibility for policymakers and investors alike.

The U.S. Economy: Shutdowns, Surges & Safe Havens

Markets are moving fast, driven by tech optimism and macro uncertainty. With the government shutdown delaying key data, investors are relying on momentum and speculation. Whether this rally holds will depend on Fed signals and ETF decisions later this week.

Weekly Economic Snapshot - Oct. 4th

As we step into the second week of October, the U.S. economy continues to navigate a complex landscape shaped by policy shifts, labor market dynamics, and global uncertainty. Here's a look back at the key developments from the past week and what to watch for in the days ahead.

October Forecast

After months of elevated borrowing costs, September 2025 brought a welcome shift for homebuyers and homeowners alike: mortgage rates are finally heading lower. The average 30-year fixed rate dropped to around 6.13%, marking its lowest point in three years.

This decline is more than just a number—it’s reshaping affordability and reigniting interest in both home purchases and refinancing.

Mortgage Rate Cuts as Fed Decision Looms

This week has brought a wave of optimism for homebuyers and real estate investors, as mortgage rates continue their downward trend ahead of a highly anticipated Federal Reserve interest rate decision. The average 30-year fixed mortgage rate dropped to 6.13%—its lowest level since late 2022.

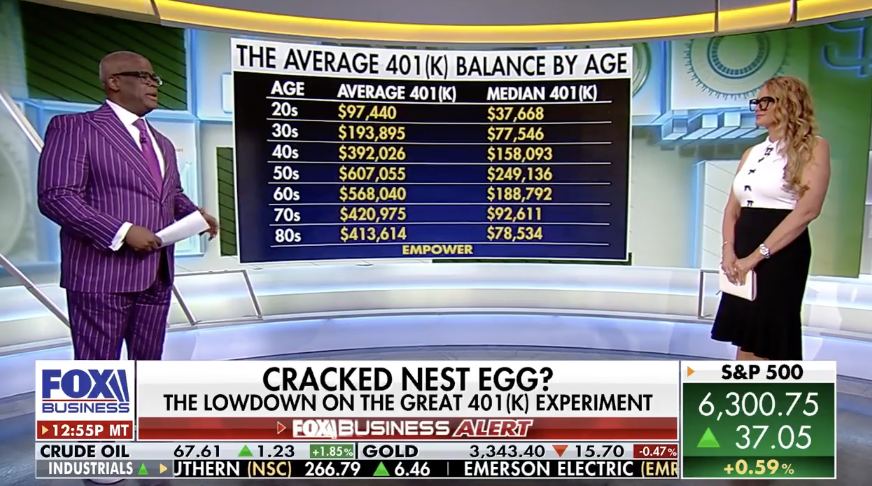

Average 401K balances reveal a big gap

‘Making Money’ host Charles Payne discusses 401(k) savings with Walser Wealth Management president Rebecca Walser and what it says about Americans’ retirement

Consequential week for the economy: Fed meeting, tariff deadline, jobs report

A series of substantial reports and meetings are occuring this week. This clip reviews this week’s agenda and how each event could potentially effect the economy.

Daily Market Report July 10th, 2025

A rally in big tech stocks led the broader market to a higher close yesterday, lifting the Nasdaq to an all-time high and helping the market regain most of its losses from earlier in the week.

Daily Market Report July 9th, 2025

The market ended mixed to lower yesterday as the Trump administration pressed its campaign to win more favorable trade deals with nations around the globe by leaning into tariffs on goods coming into the U.S.

Daily Market Report July 8th, 2025

How many times did I warn that the low level of the VIX on last Thursday’s record close put stocks into danger of getting sold off and this is exactly what happened yesterday to start the new week. In addition, we also got the President stepping up pressure on major trading partners to make deals before punishing tariffs imposed by the U.S. take effect.

Daily Market Report July 7th, 2025

U.S. stocks climbed further into records on Thursday after a report showed the U.S. job market looks stronger than expected.

Let’s work together